company income tax rate 2019 malaysia

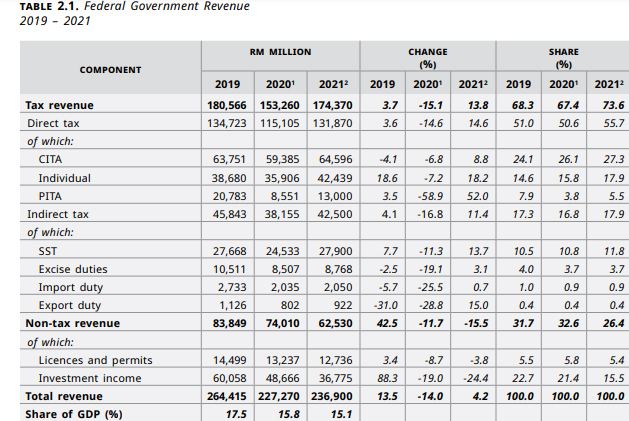

From January 1 2022 the rate was increased to 10 but under certain circumstances there are. Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021.

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Value Added Tax VAT VAT was first introduced in Bahrain on January 1 2019.

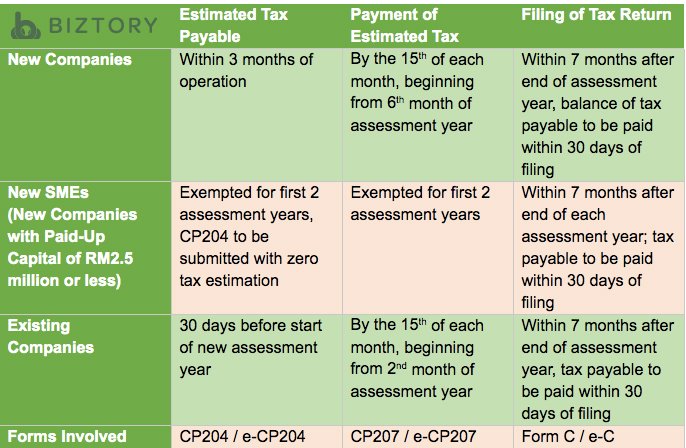

. On the first RM 600000 chargeable income. On the First 20000 Next 15000. Although tax rates may vary based on yearly budget announcements corporate income tax must be submitted and filed on a yearly basis similar to an individuals personal income tax.

-Visitors This Month. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Malaysia Non-Residents Income Tax Tables in 2019. The maximum rate was 30 and minimum was 24. The rate of WHT on such income is 10.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Data published Yearly by Inland Revenue Board.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide. Historical Data by years Data Period Date Historical Chart by prime ministers Najib Razak Abdullah Badawi Mahathir Mohamad.

What is Corporate Tax Rate in Malaysia. The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia Chinese Services Group. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Company with paid up capital not more than RM25 million company tax rates is 17 on first RM600000. A business source. Malaysia Income Tax Rate 26 Corporate Tax Rate 25 Sales Tax Service Rate 5 - 10 Personal Income Tax Malaysia individual income tax rates are progressive up to 26.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. For example lets say your annual taxable income is RM48000.

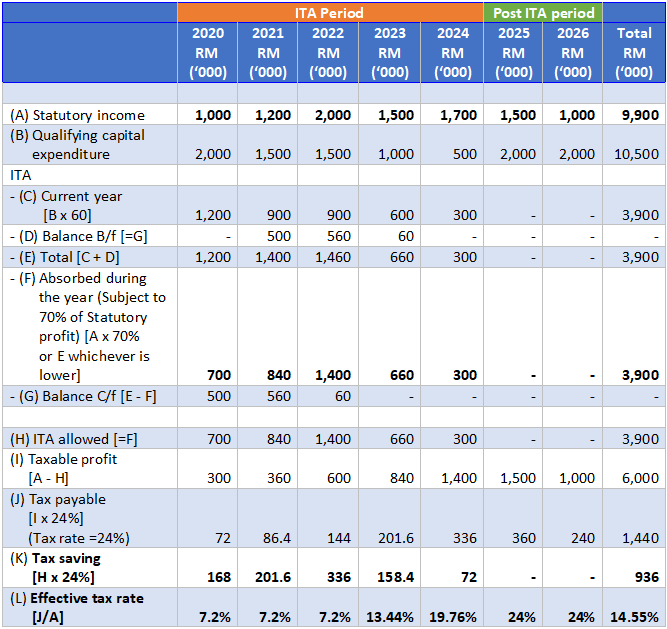

On subsequent chargeable income. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia. Income attributable to a Labuan business.

Calculations RM Rate TaxRM A. Headquarters of Inland Revenue Board Of Malaysia. Tax Rate of Company.

Paid-up capital of more than RM25 million. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less.

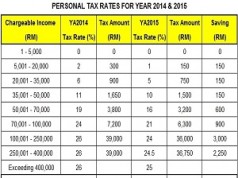

Here are the income tax rates for personal income tax in Malaysia for YA 2019. For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above which have generated high income during the COVID-19 pandemic as follows. If the paid-up capital is RM 25 million or less for a resident company when the basis period of annual assessment commences the company tax is 18 on the first RM 500000 of income and it rises to 24 on the successive increment of.

On the First 5000. On the First 50000 Next 20000. On the First 5000 Next 15000.

7 2022. Chargeable Income RM Calculations RM Rate Tax RM 0 5000. For such companies the income tax rate is set at 46 for each tax reporting period regardless of the residence of the taxpayer.

20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 23. From January 1 2019 to December 31 2021 the total VAT rate was 5. 11 rows Malaysia Non-Residents Income Tax Tables in 2019.

Personal Income tax rates applicable to taxable income are as follows. Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. Amending the Income Tax Return Form.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. On the First 35000 Next 15000. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019.

Taxable Income per year RM Tax rate RM 0 - 2500 Exempt RM 5501 5000 1. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. 8 2022 -Visitors This Month.

Gst In Malaysia Will It Return After Being Abolished In 2018

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Income Tax Malaysia 2018 Mypf My

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

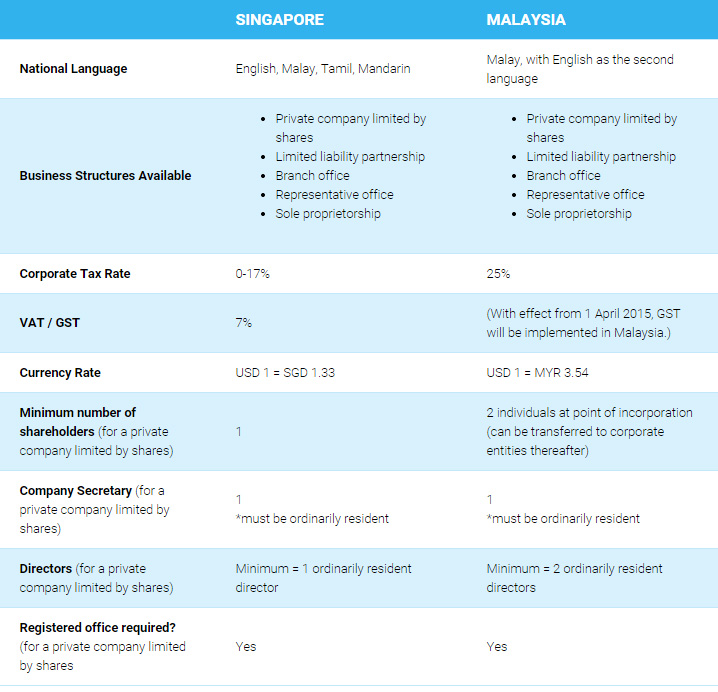

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Individual Income Tax In Malaysia For Expatriates

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

0 Response to "company income tax rate 2019 malaysia"

Post a Comment